There’s truth in jest as the saying goes. While FasterSkier’s April 1 piece made light of the issues, it hit home in some unexpected places. During one of FasterSkier’s conversations with the Environmental Protection Agency to examine why it had begun investigating the importation and sale of perfluorinated waxes, the EPA’s representatives cited the April 1 piece to question why FasterSkier had begun reporting on the issue. Whether readers appreciated the humor or not, the April 1 piece was intended as entertainment. This is our first story detailing what we’ve learned so far.

Let’s start with the EPA.

As part of a broader national compliance initiative, the EPA has begun auditing the ski wax industry. After emailing detailed questions to the EPA regarding its regulatory guidelines, the agency stated it was unable to speak broadly about the ski wax industry. It remains an ongoing enforcement issue for the EPA.

“EPA has identified certain ski waxes manufactured, processed or imported into the United States contain per- and polyfluoroalkyl substances (PFASs), also referred to as perfluorinated chemicals (PFCs), that may be in violation of the Toxic Substances Control Act (TSCA). These waxes were identified both in brick-and-mortar stores as well as available for sale domestically on e-commerce websites. As a matter of policy, the Agency is unable to discuss compliance monitoring targeting and/or investigations in more detail.”

Challenges for Swix and Toko in Winter 2018

Swix and Toko are the two largest brands of wax imported and distributed in the U.S. Both lines are imported and sold domestically by Swix USA. Swix USA is a subsidiary of its parent company, Swix Norway. According to Steve Poulin, CEO of Swix USA, the company was first contacted by the EPA during the winter of 2018 about meeting specific EPA mandates. In what became a steep learning curve regarding EPA compliance, Poulin said Swix/Toko began a review of “every product in every mixture.” We’ll explore what being EPA compliant entails later on, but it remains an exacting process that involves knowing the chemical recipe list for every Swix/Toko products imported, sold, and used in the U.S.

That formal review process began 18 months ago for Swix/Toko. Poulin said the company quarantined its entire wax line in June of 2018. They then chose not to sell perfluorinated products on their direct sales websites or ship product to their U.S. based retailers this past ski season. Many non-performance wax product, known as non-fluorinated waxes were shipped to retailers and sold.

“I decided to quarantine everything because I wanted to go through the full review and be 100 percent compliant and follow EPA regulations,” Poulin said. “I decided to be completely safe and I guess cautious, so we decided to quarantine our waxes and not ship anything until we went through the proper review process with the EPA. It was our decision.”

The Swix and Toko LF, HF, and top-coat/finishing product you may have purchased from online or brick and mortar shops was the back stock retailers possessed from this year’s inventory — shipped before June 2018 — after Swix/Toko has been contacted by the EPA.

“I shipped wax to retailers before I quarantined the whole line … I did ship wax, early preseason orders, I filled stores up,” said Poulin. “Because we were not bound, we did not find any violations at that point. And then when we discovered the true complexity of what they were asking for and compliancy regulation, that is when I put a halt to it. To be completely safe and in cooperation with the EPA.”

Outside of the Swix and Toko wax lines, skiers interested in a competitive advantage through ski wax chemistry had perfluorinated options from brands like Vauhti, Start, Star, Solda, HWK, Rex, Holmenkol, and others. The impact of the current regulatory environment on those brands is less well understood, but most were available this season.

Poulin said in a July 8 phone call that Swix/Toko will be selling performance ski wax this upcoming season.

Speed Comes at a Cost: Fluorochemistry Background

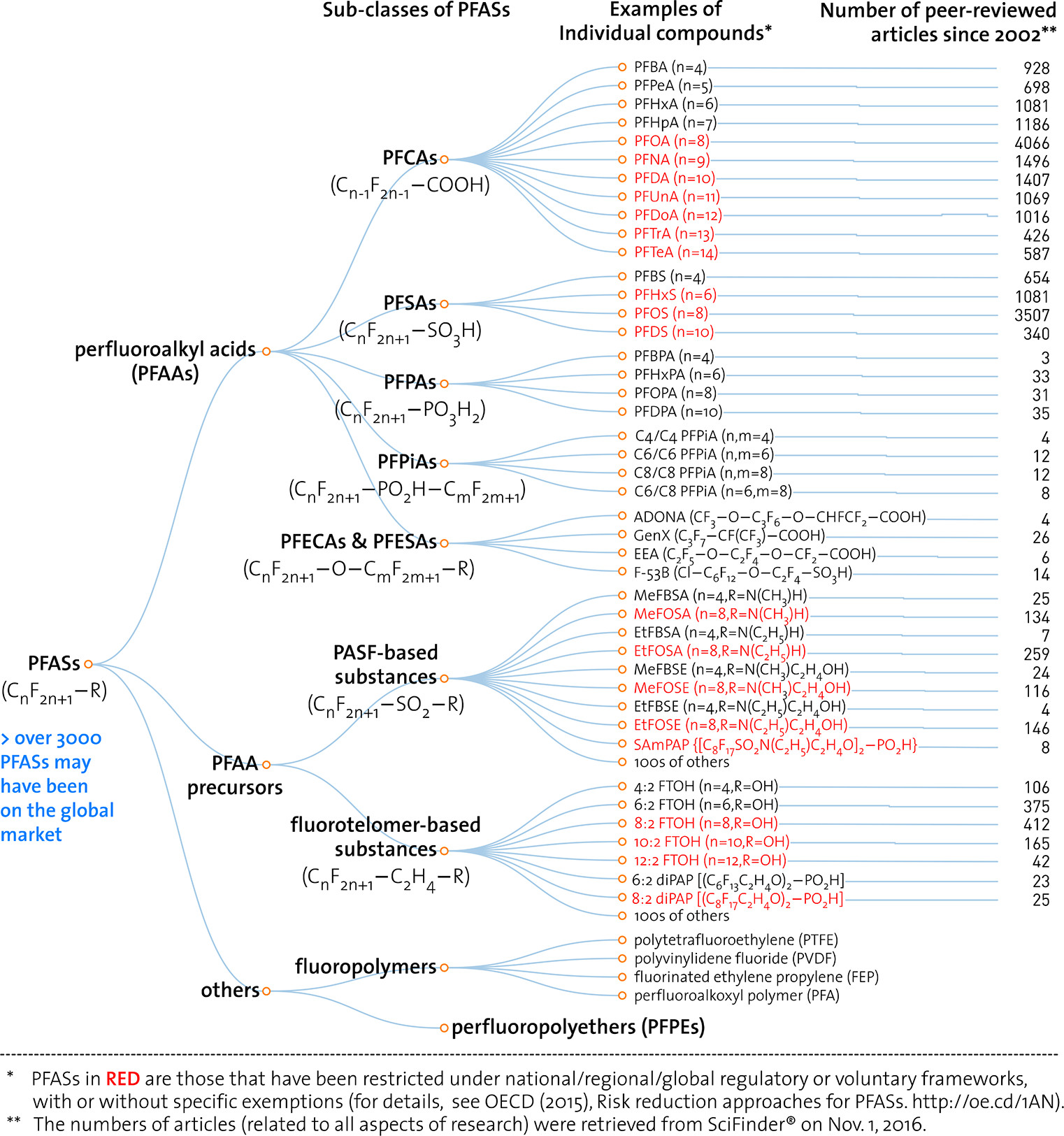

Get ready for some basic O-Chem. (For your reference, click the image titled “A Toxic Family Tree” to assist with understanding perfluoros and their chemical lineage.)

According to Dr. Merle Plassmann, the lab manager at the ACES (Department of Environmental Science and Analytical Chemistry) at Stockholm University in Sweden, perfluorinated ski wax is complicated. Plassmann’s Ph.D research examined fluorinated compounds in ski wax and their presence and fate in the environment.

Plassmann explained that his research detected numerous fluorinated compounds with carbon chains between C6-C22 in some ski waxes. He added that many fluorochemicals found in ski wax are not added deliberately but are impurities from the manufacturing process. He referred to those chemicals as PFAAs – or Perfluoroalkyl Acids. He also wrote that ski wax manufacturers do add semi-fluorinated and fully fluorinated alkanes to their product. Again, these compounds are long carbon chains with the “semi” versions partially fluorinated, the “full” versions are saturated with fluorine. Plassmann went onto explain that the constituent parts of today’s wax could be more complicated. He has not assayed ski wax since 2011.

Some skiers may throw caution to the wind and take ski speed at all cost. It’s well known that in certain conditions, perfluoros applied properly to a ski base makes those skis faster. So we asked Plassmann the burning question: What are the ingredients in ski wax that might be of concern?

“Of potential concern are not only the impurities (the PFAAs which show low levels but still can be found in the ski tracks afterwards) but also the main ingredients, which are either fully fluorinated alkanes or semi-fluorinated alkanes,” Plassmann replied. “To my knowledge, nobody has studied their environmental fate, except the one study we performed on their behaviour during snow melt and presence in snow and soil from a ski track in Sweden. Here we found that they strongly sorb to particles and thus can be found after snow melt in the soil underneath the ski tracks. But nothing is known regarding their possible breakdown. As the Carbon-Fluorine bond in molecules is a very strong bond, those chemicals will be very persistent, but for example with the semi-fluorinated alkanes, the not fluorinated part could be breaking down, thus potentially leading to the formation of PFAAs. This, however, has not been studied and shown to happen.”

In May of 2016, the EPA released a document explaining some of the health risks associated with exposure to certain perfluoros. They include thyroid disorders, hypertension and preeclampsia during pregnancy, and testicular and kidney cancer.

Bringing Science to the Market

When you head into the local shop and ask for the wax goods, the response can be confusing. We’ll refrain from using the term “pure fluoro”. There are varying percentages of fluorocarbons in gliding and kick wax product, none that we can confirm are 100 percent “pure” fluorocarbon. The products containing the highest percent perfluorinated compounds are used for glide and often come in the form of a powder, block, liquid, or gel.

All brands have their own trade secrets when it comes to percent perfluoro and hydrocarbons added. The terms used in the industry like low-fluoro, high-fluoro, and super-fluorinated are marketing terms, not a standard. Brand X might have a 40 percent perfluoro HF wax, brand Y, thirty percent. Amongst the super-fluorinated gliding products, those percentages vary too from brand to brand as do their naming devices. Start wax’s naming devices, for example, use the term “ultra high fluor glider” for its highest perfluoro content finishing product.

Hydrocarbon or paraffin wax is what we would consider the cheaper and sometimes less effective means to make a ski slide on snow. These waxes are perfluoro free.

We’ll refer to any wax with fluorinated compounds as perfluorinated wax.

PFAS, the broad group of perfluorinated substances to which PFAAs belong, are ubiquitous and can be toxic. From fire suppressing foams, stain-proof carpet and upholstery coatings, non-stick pans and food wrappers, and that snazzy waterproof jacket, fluorochemicals make these products “work”. The perfluoros in ski gliding products fall into the PFAS class.

This February, the EPA published a “Per- and Polyfluoroalkyl Substances (PFAS) Action Plan” to further address the issue of perfluoros in the environment. The action plan states, “there is evidence that continued exposure above specific levels to certain PFAS may lead to adverse health effects.”

Fluorochemicals were once considered a miracle. They are hydrophobic and repel grease, oils, and dirt. Better living through chemistry? That’s now up for debate as the EPA moves in.

The leading science journal Nature published a piece in February detailing how researchers have traced fluorochemicals in the environment back to their source. Fluorochemicals are not naturally occurring. They are all man made. So if it’s in the environment, its there due to direct use in the environment like fighting a fire at an oil-depot, or they are residual compounds from the manufacturing process that have not been contained.

(This oft-cited Scientific American article speaks to the bioaccumulation of ski wax chemicals in the blood.)

The chatter in the ski wax industry usually has to do with a subclass of PFAS called PFOAs. PFOAs will be banned in the EU for most uses starting July, 2020. In the ski wax industry, PFOAs, or what many ski-wax junkies call “C8”, is often referred to as the magic behind wicked fast skis: the actual perfluorinated turbo boost when conditions call for it. Those C8s will be replaced in perfluorinated ski products with C6 compounds. The C8 refers to a perfluoro with an eight carbon spine with fluorine atoms branching off. The C6 is a shorter six carbon spine.

Those PFOAs are often called “forever chemicals” due to their persistence in the environment. The carbon-fluorine bond is amongst the strongest known in chemistry. C6 compounds, however, reportedly breakdown more readily and are considered more benign. Many claim the C6 half-life in the environment is shorter.

Anecdotally, many ski wax experts report C8 perfluoro finishing products most often outperform C6 analogs. You probably all know someone hoarding C8 product right now. That raises several other questions about wax equity at all levels of racing.

For now, let’s put aside the O-chem and focus on the nuts and bolts of domestic regulations and remaining EPA compliant.

The EPA and the Toxic Substances Control Act: The Tools for Oversight

In 1976, during the heyday of the environmental movement in the U.S., the federal government sharpened the EPA’s regulatory teeth by passing the Toxic Substances Control Act (TSCA). The TSCA allows the EPA to better monitor the “production, importation, use, and disposal” of chemicals in the U.S.

For years, domestic ski wax producers and importers were literally off the EPA’s radar. In 2016 and 2017 the TSCA was updated with new guidelines. The hands off EPA stance evolved. The law’s 2016 amendment is called the Frank R. Lautenberg Chemical Safety for the 21st Century Act.

According to a Harvard University Science in the News article, the 2016 amendment, “gives the EPA the authority to ban new and existing chemicals that pose a risk to human health and the health of the environment. To do this, the EPA must now make an affirmative determination on all new chemicals and all new uses of existing chemicals.”

The prevalence of fluorinated compounds in the environment and the increased awareness of the potential health risks those compounds pose began to focus attention on fluoro-intensive processes. The outdoor textile industry is literally awash with perfluorocarbons — high tech fabrics that repel water owe that functional property to the carbon-fluorine bond.

A few degrees separated from outdoor performance textiles are perfluorinated ski waxes. If the EPA was following the supply chain tree to determine where fluorinated chemicals are used, at some point they’d branch-off to the ski wax industry.

The TSCA requires wax importers and domestic wax manufacturers (importers are considered manufacturers under TSCA) to properly document the chemicals used within the country.

In the past, before the EPA glanced at the ski wax industry, ski wax importers might simply declare “ski wax” on a TSCA import compliance checklist and claim the shipment complied with TSCA guidelines.

According to U.S. Customs and Border Protection, the importation of chemicals require one of two signed statements:

- I certify that all chemical substances in this shipment comply with all applicable rules or orders under TSCA and that I am not offering a chemical substance for entry in violation of TSCA or any applicable rule or order there under.

- I certify that all chemical substances in this shipment are not subject to TSCA. The statement must be typed or stamped on an appropriate entry document or commercial invoice or an attachment to that entry document or invoice.

With greater oversight, it appears the EPA found a disconnect between the chemicals contained in ski wax and what was being declared.

To be clear, none of the importers we spoke to acknowledged any intentional non-compliance. In other words, there was no intent to omit or misrepresent through their TSCA declarations. However, there appears to have been either confusion, misunderstanding, or a shift in how EPA scrutinized the forms or applied the standards that resulted in a major disruption to the ski wax market.

CAS Numbers: Millions of them

The TSCA regulatory comb is fine toothed. To meet TSCA compliance standards, wax importers require CAS numbers. CAS stands for the Chemical Abstracts Service. Every chemical substance disclosed in scientific publications are assigned a unique CAS number. Think of that number as the chemical’s numerical ID. Well beyond one hundred million chemical substances have been assigned CAS numbers. The EPA maintains a record of all the chemicals either produced within or imported into the U.S. This is known as the TSCA inventory. At its most basic, the TSCA inventory is a list of CAS numbers.

There is both a public inventory that is downloadable, and a private inventory that includes information for proprietary substances a company may not want publically available.

Here’s what’s at issue. Any material coming into the U.S., like a ski wax, must have all its chemical components, the parts that make up the sum, on the TSCA inventory. In other words, the importer must ensure that each chemical substance’s CAS number is registered on the TSCA inventory. (The TSCA inventory is organized by CAS number.) If an ingredient’s CAS number is not on the inventory, the substance cannot be imported. Further, those chemicals on the TSCA inventory must be approved for public use/consumption if sold in the marketplace.

Boulder Nordic Sport (BNS), the importer of record for several wax brands, was sent a subpoena from the EPA to ensure the CAS numbers of the perfluorinated compounds imported in their wax product were on the TSCA inventory.

“The letter from the EPA specifically asks only about fluorinated compounds,” BNS owner Nathan Schultz told FasterSkier on March 28. “However, legally, everything that is in those substances, everything that is in the wax, including dyes, colorings, perfumes, whatever, every chemical compound has to be on the TSCA inventory.”

Finding and cross-referencing CAS numbers on the TSCA inventory meant Schultz had the tedious task of obtaining a chemical specific ingredients list for every perfluoro containing product BNS imports. BNS imports Skigo wax, Holmenkol and Guru products.

“And so basically what people are finding out is that this really complex process of having to identify every compound in the substances that we are importing,” Schultz added.

“All these formulations are secret. That had been one of the challenges, that all of this information has to be kept confidential, and so we have to take extra steps to protect it from when the suppliers give it to us. One of the suppliers refused to give us the information. They say they will only give it directly to the EPA. Right now, there are some fluoros available that are on the TSCA inventory and they are OK to use. And then there are some that aren’t and the ones that aren’t are not available, they are off our site.”

In Schultz’s case, he began cataloging CAS numbers during the Federal Government’s shutdown which ran for 35 days beginning on December 22. So getting timely responses from the EPA was challenging.

As Schultz bolstered his knowledge of the TSCA, he learned that if a specific CAS number (or compound) is not on the TSCA inventory, importers do have a few options. One option is to apply for a pre-manufacture notice. (Again, importers are treated as manufacturers when it comes to TSCA compliance.)

A pre-manufacture notice is no small hurdle to jump. The notice must be filed 90 days prior to manufacture/import. The EPA also requires mounds of chemical related information including available test data on the effect to human health or the environment.

Another option to continue importing and selling a product with an ingredient not on the TSCA inventory is to file for a low volume exception. This is what it sounds like: it’s a way to declare that the substance in question will be manufactured/imported in low quantities. In this case, at or below 10,000 kg/year.

Each low volume exemption filed is for a specific chemical. If, for example, a type of performance wax contains 10 distinct chemicals, that’s 10 distinct low volume exceptions to be researched, filed, and paid for.

The potential cost associated with filing a single low volume exception is prohibitive for a small business like BNS. Those costs also don’t factor in potential legal fees.

“It is hard to say and it is also a challenge because a low fluoro paraffin wax is probably going to be 5% maybe 10% of the fluoro compound itself,” Schultz said as he contemplated how much perfluorinated substances were being imported via the wax industry. “So the pure fluoros, I would imagine in the entire U.S., we are certainly under 200-300 kg of just the fluorinated substances. The whole number is small when considering the fluorinated compounds and I mean, 100 kg, 1000 kg I don’t know what it is. I have not calculated that out. It is a small number. Certainly, all of the wax industry in the country could be under that 10,000 kg weight limit for a low-volume exemption. So relative to other uses, we are tiny.”

How did we get here?

Longtime industry insider, Andrew Gerlach, knows the ins and outs of importation. For many years he’s imported Start wax manufactured by Start Finland through his business Endurance Enterprises. According to Gerlach, Start products are the third most widely used nordic ski wax in the U.S.

The common story about wax importation and environmental regulations that we heard from Gerlach and others was something premised on the notion that European safety guidelines are stricter. The assumption was U.S. importers of ski wax must be in TSCA compliance if the waxes in question could be sold within the European Union.

“We have been doing things the same old way for decades,” Gerlach said in early April. “The European manufacturers or primarily the European manufacturers of the wax have told us, have given us a broad opine of all the ingredients in our wax and said this meets or exceeds European standards for chemical transport chemical distribution chemical use. And therefore if it meets European standards, they are tougher in every aspect than American standards, so you are good to go. So we import wax and we have a very good understanding of the ingredients within that wax but not the final nature of their pure chemical compound because that is very proprietary and most of us are mere distributors of the brand and the products and not part of the parent company.”

The EPA’s involvement with ski wax has nothing to do with EU chemical regulations known as REACH. And the EU’s regulations on the use and sale of perfluoros have nothing to do with cross-referencing CAS numbers with the TSCA inventory and being EPA compliant.

That said, the domestic wax importation industry in the U.S., like Gerlach said, had been following Europe’s lead.

EU chemical regulations originate with REACH, or Regulation, Evaluation, Authorisation and Restriction of Chemicals. REACH dates back to 2006 and has evolved and been refined many times since. The REACH net has captured the use of PFOAs, or “C8”, in the supply chain.

PFOAs will be banned in the EU for most uses starting July, 2020. They will be replaced in the ski wax industry with C6 compounds.

“We have taken Europe’s word for it,” Gerlach said. “That if their products meet or exceed European REACH standards, which they have all, they are told in the research they are tougher than American standards. So we import the wax, and everytime we have an import shipment coming in, we sign a form that says these products comply to TSCA standards.”

Back in November 2018, Gerlach said he heard rumblings within the ski community that Swix and Toko were having issues selling product. He initially, like many people, thought this had to do with pending EU restrictions on the use of PFOAs.

C8 or C6, Gerlach assumed he was TSCA compliant. Good enough in Europe, by default, meant good enough in the States. But the story circles back to CAS numbers and the TSCA inventory.

“I felt that I had better figure out what was going on, because if Swix-Toko had errors, there is the likelihood that I had errors and every other wax company that is importing had errors because we are all pretty much importing like substances in the same manner,” Gerlach said.

Gerlach contacted an EPA official in Chicago since his company is registered in the Midwest. He left a voicemail and some follow up emails. Gerlach heard nothing back.

In the meantime, Gerlach said he conversed with Schultz at BNS and became better informed about the CAS number TSCA inventory dilemma. He also communicated with the EPA’s Washington D.C. bureau and received a response when the government shutdown ceased in January. During this time, Gerlach reached out to Start Finland to secure CAS information and detailed wax recipes.

“I discovered that the vast majority of ingredients in Start wax be it perfluoros, be it hydrocarbons, be it alcohol based liquids, petroleum based liquids, on and on, all used ingredients as Start signified since day one that are on the TSCA inventory,” Gerlach said. “We did have a couple waxes with CAS numbers not on the inventory and so overtime, it took a while to delve and discover and learn all these things.”

Gerlach self-imposed a ban on selling or continuing to import product he believes is not in full compliance with the TSCA. He even went a step further.

“We have done our own self-disclosure to the EPA, saying ‘hey we have imported, unknowingly, we have imported some wax with ingredients that are not on the TSCA inventory,” said Gerlach. “They amount to these items with this amount of volume in the past five years and this is what we are planning on doing etc. with them’. As far as I can tell from my brief discussions with the EPA, I just need to focus on my ingredients list and make sure they are on the TSCA inventory and with a double bullseye focus on the perfluorocarbons and make sure those are on the TSCA and if they are on the inventory they are good to go and there’s nothing to report.”

The TSCA compliant Start products, which Gerlach said was 97 percent of the Start Wax line, are still imported and distributed to dealers around the country. His non-compliant inventory remains under quarantine in his warehouse and is not included on next year’s price list. This self-imposed restriction was taken not due to any EPA action, but as a precaution until he is told what to do with those items by the EPA.

Gerlach also explained that moving forward, Start Finland’s ingredients would meet TSCA requirements. According to Gerlach, Start Finland does not produce its own perfluorocarbons for use in their waxes. They source that from a chemical manufacturer and supplier.

“Start Finland now examines the ingredients they are putting in beforehand, “ said Gerlach. “Before they start mixing up compounds, they make sure that the ingredients that they are using are on the TSCA inventory. I am talking milliliters of fluorocarbon and grams in all my waxes that are fluorinated and whatever the law is we need to follow it. I am much more educated on what is in our waxes than I was a year ago. And Start Finland is much more aware that being good enough in Europe is not necessarily in itself good enough for America.”

Gerlach’s initial chemical bookkeeping and self-reporting were steps. He was told by his lawyer to use a statute of limitations of five years for documenting what he had imported during that time span and discerning if it was on the TSCA inventory.

That five year limit appears to be an unofficial timeframe for the statute of limitations on importing non-TSCA compliant chemicals.

“A subpoena letter I have seen did not put a date on it,” Gerlach explained. “It said, tell us all about waxes with fluorocarbons in them and the times you have imported them. And surprisingly it did not give a time frame. It just said tell us everything.”

Exhausting his avenues to remove his “violating items” from circulation Gerlach contacted Start wax retailers.

“I have looked at my orders for the last two years of these and emailed the dealers and explained that if you have any in stock I will take it back,” said Gerlach. “I did a recall of any of the waxes and none of those waxes are left in stock. And so there is nothing to recall because it has been such small quantities.”

This was what Gerlach called a voluntary recall.

In years past, Swix USA has shared prime real estate with a retailer at the American Birkebeiner expo — they were housed within the same display.

Not this year. At the Swix concept area at the expo, Swix did not sell perfluorinated product. However, Swix perfluoro products were for sale through a retailer at the expo.

FasterSkier is unaware of any official recall of non-compliant ski wax product. According to Section Five of the TSCA, any chemical not on the TSCA inventory is considered a “new chemical”. “New chemicals” to be imported and used within the country are subject to rigorous guidelines to determine their fate. A recall of pre-existing non-compliant substances by importers/distributors and retailers appears not to be one of those steps.

A quick search on the web shows product still available for sale by retailers in limited quantities.

In my candid interview with Gerlach, he was mildly prophetic as we signed off.

“So, the earthquake has happened, no one is sure about the tsunami, but no matter what, there will be a shakeout of brands and or waxes because of this,” said Gerlach

In early May, I received an email from a reader saying HWK USA was no longer in business. At the time of publication, FasterSkier had not received a reply from HWK USA after messaging and emailing the company.

Ear to the Ground

Like Gerlach and Schultz, Caldwell of the eponymous Caldwell Sport based in Putney, VT. has had his ear to the ground. Caldwell is known for custom ski selection and grinding services, but also retails wax. In the past, he was an importer of Vauhti wax out of Finland. Vauhti is now imported by Park City, UT., based Sisu Sports.

Caldwell sells wax online, or onsite at select races during the season. He sells Rex, Rode, Star, and Vauhti products.

“So what I know is that the EPA instructed [Swix] to stop selling when they went through item by item and reviewed the contents of what they were selling — and that is it,” Caldwell said when asked what he knew about the direct discussions between Swix/Toko and the EPA.

At the time of our conversation on April 9, Caldwell said he had had no contact with the EPA to date.

Caldwell Sport’s role as a retailer rather than importer means its relationship with the TSCA is indirect. Caldwell Sport is not responsible under the TSCA, for ensuring the wax it sells is compliant — that remains the importer’s role.

“My understanding is that the EPA’s concern is with importation and that they are not concerned at the retail level,” Caldwell said. “They are concerned at the chasing things to their source, where they are coming into the country. So I have not heard of any retailer who is not an importer being instructed to stop selling product. For instance, no Swix retailer that I am aware of has been told they cannot sell Swix waxes. But Swix the importer which is also owned by Swix Norway has been told they cannot sell waxes which would mean both at wholesale and at retail.”

Caldwell’s process of obtaining perfluorinated wax products is simple. For example, he orders Vauhti product directly from SISU Sports. It then ships UPS from Utah to Vermont.

“As far as I know, there is no oversight of that aside from regular domestic shipping restrictions on air, on flammable goods for air shipments,” said Caldwell. “You cannot put some of the solvents on an airplane. So we have to be cautious about that and plan shipping. We are just ordering form those guys.”

For Caldwell Sport, it has been business as usual. Caldwell said he resupplied with Start and Vauhti this spring with no issues. Yet Caldwell was mindful of his stake in the high-end wax game. As a small business he is evaluating how to proceed as perfluorinated waxes come under scrutiny.

“From our point of view, the question has been whether we should try to anticipate action by the EPA and pre-order a whole bunch of stuff or whether we should continue to run as we normally do to run a lean family business,” said Caldwell. “We cannot afford to carry a huge quantity of really high-end wax because it cost a whole lot to have. As a family business retailer, we are in a position where we need to be pretty cautious about how far we stick our neck out on a lot of high-end product.”

Patrick Coffey, the Vauhti brand manager for Sisu Sports, emailed FasterSkier to state that as of May 24, he still had not been contacted by the EPA.

“There’s no reason for me to expect it at any given point, but given that it’s the offseason, my approach will be to see what we need to do to make sure that there will be no delays in delivery late summer when the product comes from Finland to Utah,” Coffey said during an April phone call.

“If someone within a government agency wants to get in touch with us and ask for information, I’m going to get that information,” said Coffey. “The goal here is not to keep our head down and hope nobody notices, I want to make sure that we’re in a position, because retailers are asking ‘are you able to bring product in?’ and I’ve told all of them at this point ‘yes’. If anything changes they will be the first to know, because I don’t want them to all of a sudden to realize in December that they are not getting product.”

The Bigger Picture

The wax industry remains a drop in the financial and environmental degradation bucket when considering the widespread use of perfluoros in industry. But, perfluorinated compounds are making news. High Country News published a piece about PFAS pollution on May 30. Several news outlets have reported that the state of New Hampshire is suing chemical giants 3M and DuPont “for damage it says has been caused by a class of potentially toxic chemicals found in pizza boxes, fast-food wrappers and drinking water,” according to a Boston.com piece.

The ski wax industry has been reforming when it comes to using the more caustic C8 and longer chain chemistry in its waxes. The type of fluorochemistry that has been newsworthy. Longchain fluorocarbons are on their way out and C6 chemistry is in.

Is the ski wax industry and the quest for ski speed to blame for shirking environmental regulations and drawing attention to itself? Probably not. It’s simply that the EPA has the law on its side and the science to support its stance to bring more oversight.

Although Swix and Toko did not ship perfluorinated wax last season, it appears the EPA is conducting a broader industry-wide review. Ski waxes are obviously not the domain of skinny skis alone. Imported and domestically manufactured alpine specific waxes fall within the same regulatory benchmarks applied to popular cross-country wax brands.

Fast skis are a drug. That first slide on a slippery pair of perfluoro soaked boards can be dreamy. But, everybody pays to play for that speed.

For now, it seems certain that your ski speed fix, thanks to modern chemistry, will and can be satiated when snow falls next winter. But the Swix/Toko challenge this season has the potential to be a more significant industry wide challenge moving forward. There’s no question, those little vials of speed be it in liquid, block, powder, gel, or fluorinated hydrocarbon form, will have regulatory fingerprints all over it.

Jason Albert

Jason lives in Bend, Ore., and can often be seen chasing his two boys around town. He’s a self-proclaimed audio geek. That all started back in the early 1990s when he convinced a naive public radio editor he should report a story from Alaska’s, Ruth Gorge. Now, Jason’s common companion is his field-recording gear.